QuickBooks Desktop Accountant is accounting software designed specifically for accounting professionals. The latest version, QuickBooks Desktop Accountant 2024, offers a robust set of features to help accountants efficiently manage their clients’ finances. In this article, we’ll take a close look at QuickBooks Desktop Accountant 2024, including pricing, key features, and who it’s best suited for.

QuickBooks Desktop Accountant 2024 New Features

Enhanced security

With our advanced security features, including industry-leading AES 256-bit encryption, you can be confident that your data is well-protected. QuickBooks goes the extra mile to ensure the security of vital customer and vendor information, including business financials, banking details, and credit card information, thus safeguarding your reputation.

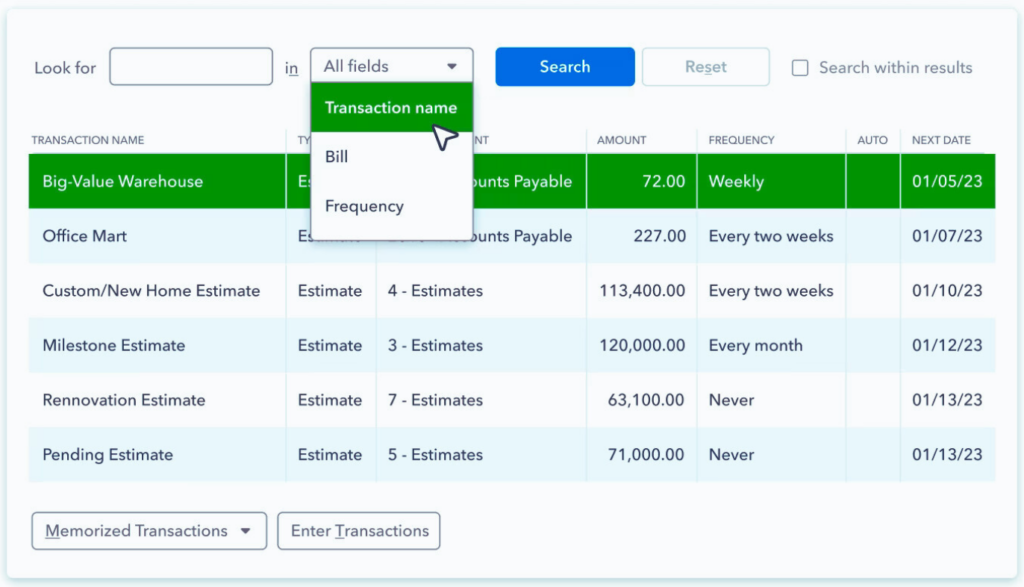

Improved search of item lists

Increase your efficiency with the improved search function, which allows you to swiftly locate specific items within extensive lists of memorized transactions, fixed assets, or payroll items. This enhanced feature also enables quick edits to transactions and entities, eliminating the need for manual scrolling as in previous versions.

Seamless product updates

Your clients will no longer experience disruptions caused by product updates, as QuickBooks Enterprise seamlessly installs them in the background. Moreover, they can effortlessly access information about available product updates and their timing, empowering them to make informed decisions regarding installation.

Powerful productivity

Access critical tools easily using the Accountant Toolbox, enabling you to take action from anywhere and simplify your daily tasks. With Accountant Toolbox4, you can conveniently access it from your clients’ QuickBooks Pro or Premier, whether remotely or in a hosted environment. Swiftly identify and rectify entry errors with Client Data Review and efficiently manage large volumes of transactions by deleting, voiding, or reclassifying them in bulk. Additionally, you can streamline writing off multiple invoices on a single screen.

Client collaboration

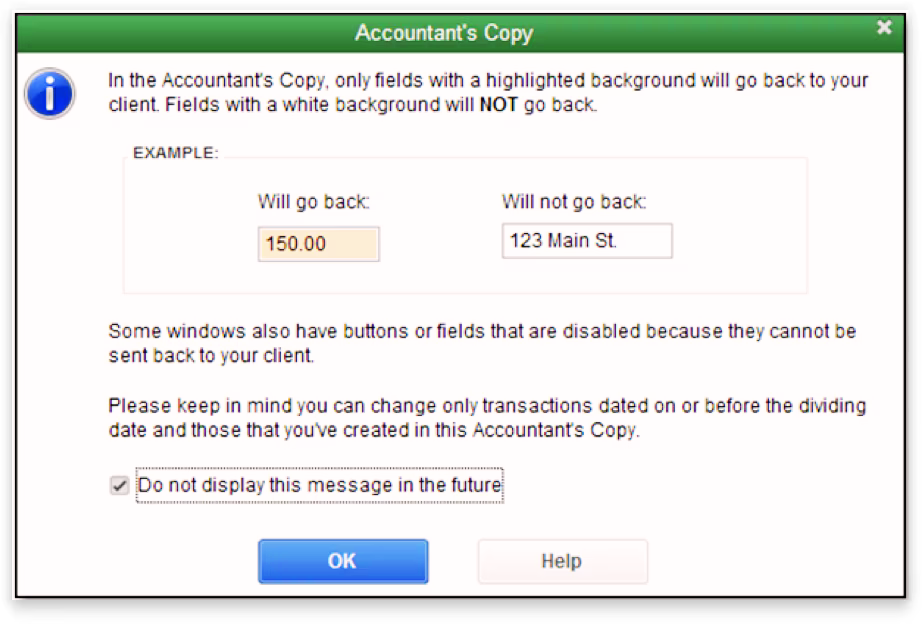

- With the Accountant’s Copy feature, you and your clients no longer need to coordinate your work schedules.

- Effortlessly transfer files instead of the hassle of saving your work to a computer or USB drive.

- You can work on your version of your client’s files, even if they work simultaneously.

- Your adjustments are seamlessly and swiftly integrated.

Work flexibility

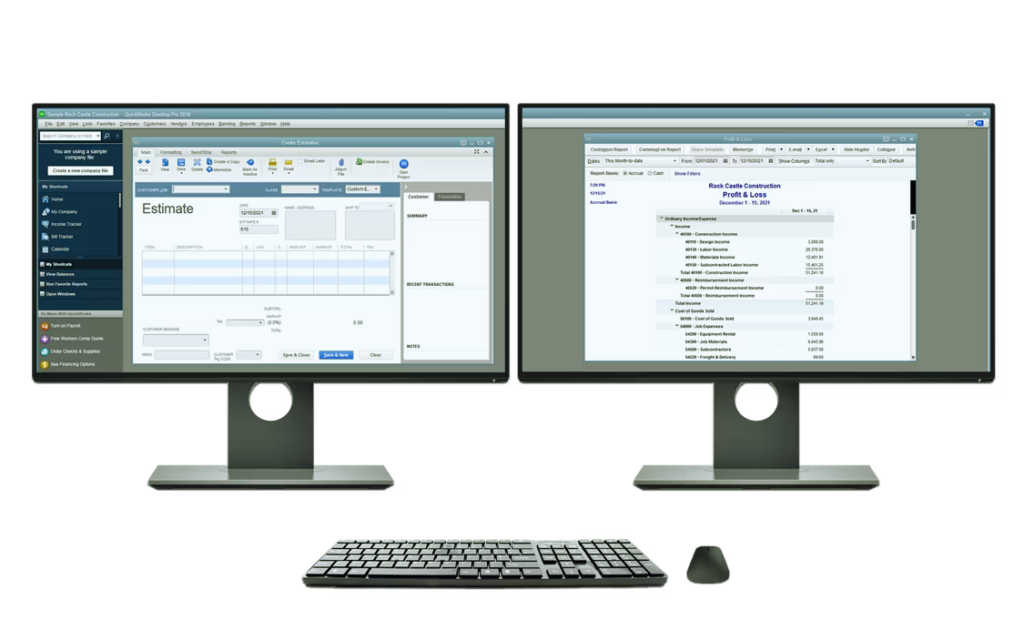

- Customize your workspace to boost efficiency and productivity with Multi-Monitor mode.

- Streamline your workflow by seamlessly handling two company files simultaneously using Multi-Instance.

- Speed up the process of finding items, accounts, and clients with the search auto-fill feature.

- Easily locate a range of values to quickly retrieve transaction amounts.

QuickBooks Desktop Accountant 2024 Pricing

QuickBooks Desktop Accountant is only available as a subscription model, billed annually. There are two versions available:

- QuickBooks ProAdvisor Program: $549.95 per year

- QuickBooks Accountant Edition: $799.95 per year

The ProAdvisor version offers the core QuickBooks Desktop Accountant software. The Accountant Edition includes additional tools like Accountant’s Copy File Transfer Service, Client Data Review, Accountant’s Copy File Repair Service, and more.

There are discounts available for multi-year subscriptions. For example, a 3-year ProAdvisor subscription is $1,439.85 ($479.95 per year). Additional discounts may be offered for larger accounting firms that purchase multiple licenses.

QuickBooks Desktop Accountant subscriptions allow you to install the software on up to 2 computers. Add-on pricing is available if you need to install it on more devices.

QuickBooks Accountant Desktop 2024 System Requirements

- Client: Windows 10 (64-bit) or Windows 11 (64-bit), update/version supported by Microsoft. Windows 8.1, Windows 10 S mode, Windows 11 IOT, and Linux are not supported.

- Server: Windows Server 2016, 2019, or 2022 (Regular or Small Business Server)

- 2.4 GHz processor

- Client RAM: 8GB RAM; 16GB RAM recommended; Server RAM (for multi-user support): 8GB (5 users)

- 2.5 GB disk space recommended (additional space required for data files); Solid State Drive (SSD) recommended for optimal performance

- Plus, subscriptions, Payroll, and online features require Internet access.

- QuickBooks Desktop App access is included with Desktop subscriptions. Must be installed on a camera-enabled mobile device using Android 6.0 or iOS 12 or later

- Product registration required

- It is optimized for 1280×1024 screen resolution or higher. Supports one Workstation Monitor plus up to 2 extended monitors. It is optimized for Default DPI settings.

- Google Chrome recommended

Integration with other software

- Microsoft Word and Excel integration requires Office 2016-2021, or Microsoft 365 (64-bit)

- Transfer data from Quicken 2016-2022, QuickBooks Mac/Mac Plus 2021-2024 (US only), Microsoft Excel 2016 – 2021, Microsoft 365 (64-bit)

- Email Estimates, Invoices, and other forms with Microsoft Outlook 2016 – 2019, Microsoft 365 (64 bit), Gmail™, and Outlook.com®, and other SMTP-supporting email clients. Integration with QuickBooks POS 19.0.®, other SMTP-supporting email clients. Integration with QuickBooks POS 19.0.

Who is QuickBooks Desktop Accountant Best For?

QuickBooks Desktop Accountant is designed for accounting professionals working with many QuickBooks clients. It provides tools to manage high transaction volume across multiple company files efficiently.

Key types of firms who benefit most from QuickBooks Desktop Accountant:

- Accounting firms – Manage many QuickBooks business clients seamlessly with the Accountant’s Copy file exchange. Utilize batch transaction entry and reporting.

- Bookkeeping firms – Maintain QuickBooks files for clients—access diagnostic tools to correct errors and ensure accurate books.

- Tax professionals – Get in-depth profit & loss data across fiscal periods to prepare client taxes—and project tax liabilities.

- Consulting professionals – Work with client data without altering their QuickBooks files. Provide feedback and best practice recommendations.

For sole practitioners and tiny firms, the full Accountant version may need to be more balanced. The ProAdvisor version offers core multi-client management features at a lower price point that may be better suited to their needs.