QuickBooks Premier offers seamless integration with Intuit’s payroll and payment processing services. Connecting these features into your Premier workflow can save significant time on bookkeeping, payments, and payroll administration.

This guide will walk through how to get set up, configure, and use integrated payroll and merchant services with QuickBooks Premier.

Integrate QuickBooks Payroll

QuickBooks Payroll enables handling payroll completely within Premier for simplified payroll processing and taxes. Here are the steps to integrate it:

Activate Payroll in Premier

- Open QuickBooks Premier and go to Employees > Payroll > Get Started

- Select your payroll setup options and enter the required tax details for filing forms

- Choose employee payroll settings like pay frequency, wage rounding, wage types offered, etc.

- Confirm bank account(s) to withdraw payroll funds from

QuickBooks will automatically create payroll items on your chart of accounts.

Enter Employee Information

- Go to Employees > Employee Center and click New Employee

- Enter details like name, address, date of birth, position, pay rates etc.

- On the Payroll Info tab, enter filing status, deductions, direct deposit details, etc.

- Click OK when finished with each employee profile

Thoroughly entering tax info and earning/deduction details upfront is crucial for accurate payroll calculations.

Run Payroll

- Go to Employees > Process Payroll

- Select the Pay Period dates and confirm the employees to pay

- Review the payroll amounts calculated for each employee and adjust as needed

- Click Preview Payroll and confirm all looks accurate

- Click Pay Employees to finalize the payroll—funds will withdraw to employee bank accounts

That’s it! Premier Payroll reduces an hours-long payroll task to just minutes.

Integrate QuickBooks Payments

QuickBooks Payments lets you accept payments from customers directly within Premier. Here is how to activate and use it:

Activate Payments

- Go to Customers > Payments > Get Started

- Review and agree to the terms and fees

- Enter your business and bank account information

- Select employee access permissions—who can collect payments

Collect Payments

- When creating a sales receipt or invoice, click the Pay Now button

- Enter the amount the customer is paying now

- Customer sees the payment webpage to enter credit card details

- Payment posts to the Undeposited Funds account automatically

- An email receipt is sent to the customer and your QuickBooks Payments feed logs the transaction

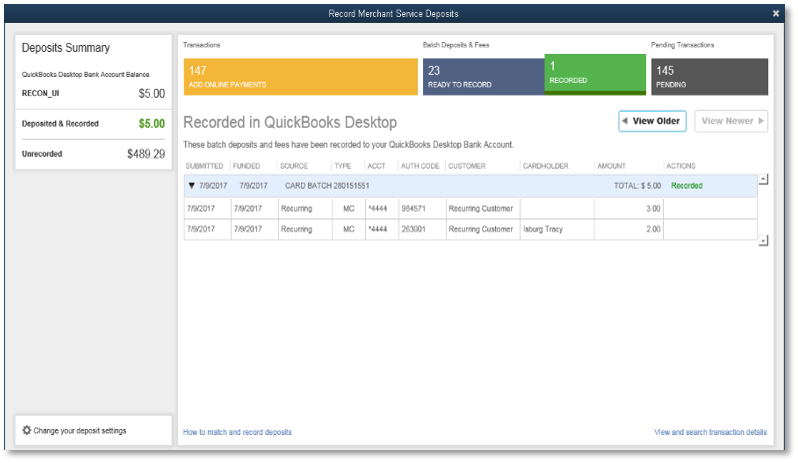

Manage Payments

Review the QuickBooks Payments feed regularly to confirm deposited payments. Use it to:

- Print receipts

- View batched deposits

- Void payments if needed

- Track transaction history

Streamline receiving customer payments without needing a standalone payment processor.

Best Practices for Integrated Services

Follow these tips to get the most value from integrated payroll and merchant services in Premier:

- Take time to thoroughly set up employees and payment permissions to prevent issues down the road

- Closely review the first few payroll runs and payments processed—verify accuracy

- Run payroll reports to audit wages, deductions, taxes, etc.

- Enable employee access so they can download pay stubs directly

- Consider automating payroll tax payments for a smoother process

- Schedule QuickBooks Payments deposits to transfer automatically each business day

Integrated services eliminate the need for importing payroll data or exporting payment details. This saves significant time, minimizes errors, and provides unified financial tracking. Carefully setting up and actively managing these integrations ensures seamless workflows long-term.